Pre-emption rights are often talked about as one of the most important terms for early stage investors. But it’s not just important for investors, it’s also a key term for founders to understand when negotiating a financing round.

First things first, what is a pre-emption right?

A pre-emption right gives an existing shareholder the right to participate in a future financing round to the extent necessary to maintain its percentage stake in the company. It provides shareholders the right to acquire shares before they can be offered to a third party (i.e. a new investor) on either an issue of new shares or a share transfer by an existing shareholder. In this post I’m going to focus on the issue of new shares and not transfers.

Pre-emption rights are usually pro rata to a shareholder’s existing holding (so if a shareholder holds 10% of the issued share capital, broadly speaking they will be entitled to 10% of the shares being issued). However, occasionally certain investors will look for a multiple of pre-emption (also known as a “super pre-emption”) which would give them the right to invest more than their pro rata. Or, less common, an investor may look to include a right where they can take the entire round at such new financing (also known as a “right of first refusal”). Rights of first refusal on a new issue of shares can be potentially toxic for founders because they effectively reduce the options available when raising a new round (discussed more here)- definitely something to watch out for.

What does this look like in a typical termsheet?

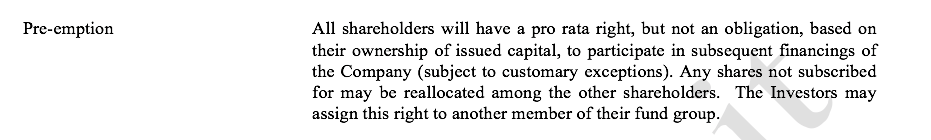

Below is an extract of how a simple pre-emption right might look in a typical VC termsheet:

This is a fairly standard and founder friendly pre-emption clause. The right is pro rata and therefore no one investor is getting any preferential treatment such as super pro-rata or a right of first refusal (see above) on the issue of new shares.

Why do investors care?

Returns in VC are driven by the outlier big outcomes. The right of pre-emption is therefore very important for investors to be able to continue to invest in their strongest performing companies and back the winners. Hence why it’s one of the key terms that any experienced investor will fight for.

Should founders care?

Yes, there are two main reasons why they should:

(1) Signalling

On a new financing round, new investors will be keen to understand if existing investors are following on at this round with respect to their pre-emptive amount (also interchangeably referred to as “pro rata”). If they’re not then this can send a negative signal to the new investor because the existing investors are expected to generally be more knowledge of the company. This is most applicable for VC funds where the expectation will be that they follow-on (less so for smaller funds).

For example, if a Seed VC has led a £1.5m seed round and post that round holds 15% then the Series A VC (considering leading the next round) will want to know whether the Seed VC is following on for their pro-rata. If they are not this could be a negative signal for the Series A VC.

(2) % available for new investors

The right to pre-emption means that on a new financing round the company will be obliged to offer the opportunity to existing investors to invest at the same terms on a pro rata basis.

For example, if following a Seed round investors hold 20% and at the Series A they are raising £5m then ~£1m (20% of this £5m) must be made available for existing investors.

Now, in practice some of the existing investors may not take up their pre-emption (e.g. Angel investors may not have liquid reserves to follow-on). However, it’s an important consideration because the amount of pre-emption taken up will effect the amount available for new investors. This could be important if the new investors have a target ownership in mind (which VCs often do). Whilst technically this is true, in oversubscribed competitive rounds there may be pressure placed on existing investors to reduce the amount they invest to provide space for new investors.

Win-win 🙌

A standard pre-emption right (like the extract above) can provide a win for both founder and investor. Investors get the crucial opportunity to follow-on in successful companies and founders get additional support, funding and a positive signal for their next financing round.

Originally posted on Medium.