We (Seedcamp) recently hosted a Legal Tech focused event in partnership with Next Law Labs to bring together influencers in the Legal Tech community and those interested in finding out more. The turnout for the event was great and speaking to the founders who came along it really feels like the space is at a tipping point. Being an ex-lawyer this has always been a space that has really interested me, I wanted to share the below map and some market insights on why I think now is a great time for Legal Tech.

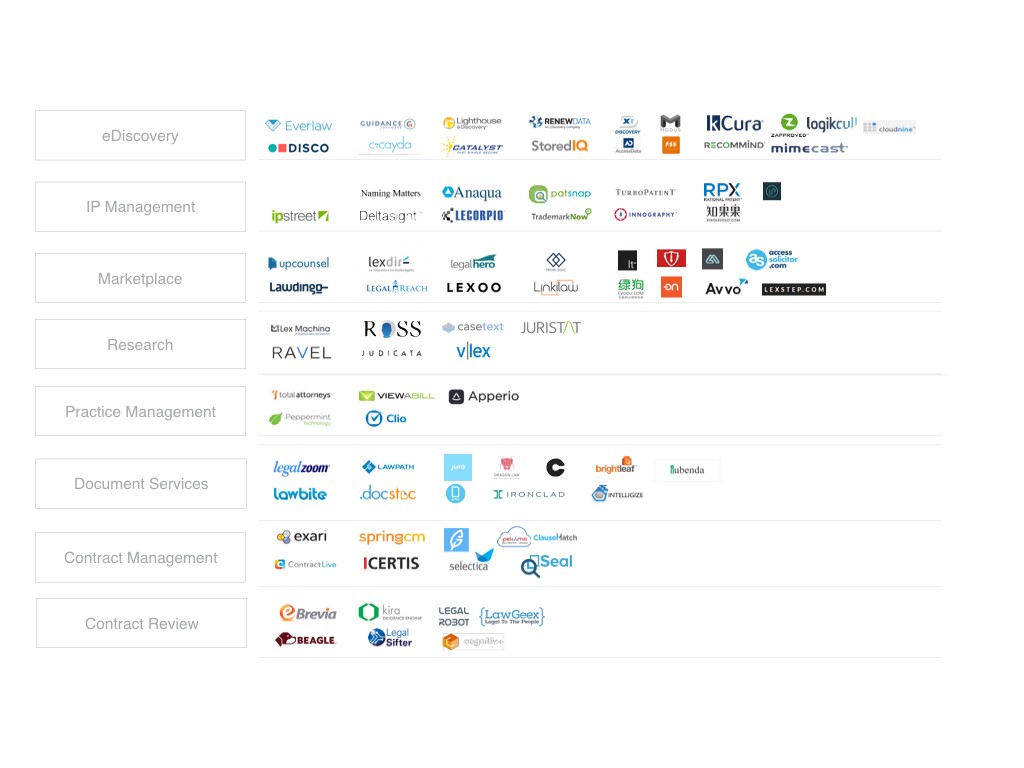

Market Map

The aim of the map is to provide an overview of many of the different startups within the Legal Tech space. It’s not designed to be all encompassing or fully comprehensive. I’ve included a full list of all the companies on the map and how much they’ve raised to date at the end of this post. If I am missing something, tweet me @tom_wils

What is Legal Tech?

Firstly, what is Legal Tech? Broadly speaking, the Legal Tech market covers companies (mostly startups) utilising technology to build products solving problems faced both by industry (i.e. law firms, corporates etc.) and consumers related to legal services.

Why now?

Whilst the space has been slow to take off (i.e. in comparison to Fin Tech), a combination of factors are coming together to make now a great time to build a startup focused on the Legal Tech space:

- Maturing ecosystem – as the map shows we are seeing increasing numbers of well funded startups. This in turn raises the profile of the industry and provides further validation for startups looking to get those first customers in a notoriously risk-averse market.

- Increased transparency – the legal services market has historically been viewed as one that is opaque when it comes to knowledge and therefore costs. The introduction of marketplace models and startups focused on document services (see the Map above) are improving this information asymmetry. This increased transparency is presenting opportunities for startups to compete with the more well-established players.

- Automation – advances in natural language processing have enabled people to build solutions addressing various verticals within the overall legal tech market (see eDiscovery, IP Management, Contract Review). In particular, such solutions are taking advantage of large data sets to assist with the automation of certain low level repeatable tasks. The opportunities here to reduce the time taken and therefore costs are significant (law firms still tend to bill by the hour). As this technology improves and the data sets they work on are scaled up it could be possible for solutions to be built to automate more advanced work.

- Innovation – we are seeing the emergence of startups that are aiming to go beyond the automation and provide additional insights (see Legal Research). Whilst this space is still in its infancy, this arguably could lead to the removal of the need to instruct lawyers for certain tasks.

- Generational shift – there is an increasing interest in the space both from those within the law (particularly towards the junior level) and those building solutions from outside the law aimed at the sector. Furthermore, law students and future practitioners will start and grow their careers utilising advances in technology.

— –

Map: Breakdown by sub-sector

I’ve taken the following as sub-sections of the overall market:

- eDiscovery – solutions to manage emails, documents and other files specific to the litigation process.

- IP Management – tools to help track and analyse trademarks, copyrights, patents and other IP assets.

- Marketplace – tools to help people find lawyers for specific matters.

- Research – tools to help lawyers with legal research and / or make more data-driven decisions.

- Practice Management – tools to help law firms with issues around on-boarding clients, tracking matters, billing, invoicing, time-tracking etc.

- Document Services – providing legal documents or forms and (in some cases) legal advice. i.e. covers contract creation, management and / or legal services.

- Contract Management – helping companies keep track and manage contracts throughout the contract lifecycle.

- Contract Review – technology solutions (e.g. natural language processing and machine learning) for automatically abstracting contract terms to help with contract review.

Map: Breakdown by company

eDiscovery

Kcura — raised $125m, developers of e-discovery software.

CS Disco — raised $12.4m, e-discovery platform.

Everlaw — raised $9.6m, litigation platform beginning with e-discovery.

AccessData — raised $45m, digital forensic, e-discovery and incident response solutions.

RenewData — raised $41m, e-discovery, e-storage risk management solutions, and forensic.

Lighthouse eDiscovery — raised $34.5m, e-discovery litigation services.

Guidance Software — raised $7.54m, e-discovery, data discovery and computer forensics.

Catalysy Repository Systems — raised $31m, provides litigation support software and hosted document repositories.

PSS Systems — raised $18m, provides solutions for legal holds and retention problem.

StoredIQ — raised $41.84m, analysis and governance of unstructured data (acquired 2012).

Recommind — raised $22.5m, enterprise search and categorisation platform automatically organises, manages and distributes large volumes of information from multiple sources.

X1 Technologies — raised $12.2m, enterprise wide collection and processing as well as review and analysis platform for litigators.

Modus eDiscovery — raised $10m, data management firm that helps organisations leverage eDiscovery intelligence.

Cicayda — raised $6.8m, Saas based e-discovery software.

Zapproved — raised $17.24m, e-discovery for corporate legal teams.

Mimecast — raised $90m, amongst other features, e-discovery (went public in 2015).

Logikcull — raised $4m, e-discovery platform.

Cloud Nine — e-discovery platform.

IP Management

Trademarknow — raised $3.5m, trademark search and watch results.

Anaqua — raised $125m, provides a range of IP management software solutions.

Lecorpio — raised $25m, provides IP management software to automate intellectual property processes.

PatSnap — raised $13.6m, search platform for patents.

Zhiguoguo — raised $3.7m, IP management software including registration and legal services.

Naming Matters — IP visual search and related naming tools.

RPX Corporation — raised $undisclosed, provides patent risk litigation solutions (went public in 2011).

Innography — raised $13.02m, patent management software.

P Street — raised $6.96m, IP and patent search tool.

Turbopatent — raised $2m, patent application and prosecution solution.

Deltasight — raised $400k, IP analysis and visualisation.

IPlytics — raised $undisclosed, monitors and analyses company’s competitive position for patenting.

Research

Ravel — raised $9.2m, legal search, analytics, and collaboration platform for lawyers. (Acquired 2012).

Judicata — raised $7.8m, turning unstructured court opinions into structured data.

ROSS Intelligence — raised $undisclosed, using IBM Watson to provide answers to legal research questions.

vLex — raised $5.2m, multilingual database of legal content.

LexMachina — raised $10m, IP, litigation data and predictive analytics to law firms. (Acquired 2015).

Casetext — raised $8.8m, community site for lawyers to share knowledge.

Juristat — raised $3m, big data analytics and research tool focused on patent prosecution.

Practice Management

Clio — raised $26m, practice management suite that is designed for sole practitioners and small law firms.

Apperio — raised $2.4m, enables firms to track legal spend at an overall or matter level, in real time. (Seedcamp is an investor).

Peppermint — raised $15m, platform that delivers application services across accounts, practice, case document, risk management.

Total Attorneys — raised $15m, practice management software and customer acquisition for attorneys.

Viewabill — raised $1.1m, real time access to time entries and billing practices.

Marketplace

Avvo — raised $132m, legal marketplace, directory, and question and answer forum that connects individuals with lawyers.

Lexoo — raised $1.7m, lawyer comparison marketplace for businesses.

UpCounsel — raised $14m, marketplace for legal services.

LawDingo — raised $790k, marketplace for virtual legal consultations.

Lexdir — raised $420k, legal marketplace and directory.

Zhuanjiabao — raised $692k, legal marketplace plus virtual legal consultations.

Priori Legal — raised $undisclosed, lawyer comparison marketplace for businesses.

Legal Reach — raised $900k, legal directory.

LawAdvisor — raised $590k, marketplace for virtual legal consultations.

Lvgou — raised $1.9m, legal marketplace.

Legal Hero — raised $750k, legal marketplace focused on fixed fees.

On Legal — legal case management platform with marketplace.

LinkiLaw — legal marketplace.

Access Solicitor — legal marketplace.

Lexstep — legal recruitment marketplace.

Document Services

LegalZoom — raised $266m ($200m of secondary), contract creation and legal services.

Rocket Lawyer — raised $53.3m, contract creation and legal services.

DocStoc — raised $4m, contract creation and sharing platform.

LawPath — raised $1.9m, contract creation and legal services.

Docracy — raised $850k, contract creation and signing.

Juro — raised $80k, contract creation and management. (Seedcamp is an investor).

Dragon Law — raised $410k, contract creation and legal services.

LawBite — raised $170k, contract creation and legal services.

Clerky — raised $120k, contract creation and management.

IronClad — raised $undisclosed, contract creation and management.

Shake — raised $4m, mobile-first contract creation. (acquired 2015)

Intelligize — raised $3.59m, legal form (i.e. SEC filings) creation and management.

Brightleaf — raised $3m, contract creation and management.

Iubenda — raised $100k, privacy policy generator.

Contract Management

Icertis — raised $21.4m, contract creation and management, focused on enterprise.

Contract Live — raised $1.4m, contract creation and management.

Avvoka — contract management.

SpringCM — raised $85m, work flow automation and contract management.

Selectica — raised $23.3m, work flow automation and contract management. (went public in 2010)

Exari Systems — raised $10m, contract creation and management.

Pekama – raised $undisclosed, contract management and collaboration tool.

Clausematch – raised $600k, contract management and collaboration tool.

Contract Room — raised $850k, contract management and collaboration tool.

Seal — raised $13m, contract management and analytics.

Contract Review

eBrevia — raised $500k, natural language processing and machine learning to understand legal language.

Legal Robot — natural language processing and machine learning to understand legal language. Focused on both B2B and B2C.

Beagle — natural language processing and machine learning to understand legal language. Focused on B2B.

LegalSifter — raised $1.6m, natural language processing for contracts.

Kira Inc — natural language processing and machine learning to understand legal language.

LawGeex — raised $2.5m, natural language processing for contracts.

Cognitiv plus — natural language processing for contracts.

Originally posted on Medium.